Guide

The DJI Ban Explained: What You Need to Know

- How the ban works: Under the 2025 NDAA (annual defense budget legislation), DJI will be added to the FCC Covered List if it does not undergo a national-security audit by December 23, 2025. Currently, no audit is scheduled. This means the ban is likely to go into effect, given how soon the deadline is.

- If you already own DJI drones: If you or your company own DJI drones you will be able to keep using them without interruption. Operators should expect to retain full flight functionality, though long-term access to firmware updates, repairs, and spare parts could become more limited.

- What could change: If DJI is added to the FCC Covered List, you will not be able to import DJI drones or get new DJI drones authorized.

- Industrial impact: For asset owners and inspection providers, the real concern is continuity of operations—making sure inspection programs, training, and data workflows can continue even if new DJI hardware becomes harder to source.

- What to do now: Keep fleets updated, document platform dependencies, and begin evaluating complementary or alternative drones as a backup plan.

DJI Drones Available from MFE

Even with a potential DJI ban on the horizon, MFE Inspection Solutions continues to supply high-end DJI platforms for industrial operators. Keep reading to see what we currently have in stock.Outdoor Delivery Drone

DJI FlyCart 30

The DJI FlyCart 30 is a heavy-lift delivery drone built for industrial logistics. With a high payload capacity, dual-battery redundancy, and flexible cargo options (cargo box or winch), it helps teams move tools, spares, and small equipment across challenging terrain or over obstacles where ground transport is slow or unsafe.

The DJI FlyCart 30 is a heavy-lift delivery drone built for industrial logistics. With a high payload capacity, dual-battery redundancy, and flexible cargo options (cargo box or winch), it helps teams move tools, spares, and small equipment across challenging terrain or over obstacles where ground transport is slow or unsafe.

- High payload capacity for industrial parts, tools, and consumables.

- All-weather design with robust propulsion and redundant systems.

- Configurable cargo options for point-to-point delivery in complex environments.

- Ideal for remote sites, plants with limited road access, and offshore logistics.

Outdoor Inspection Drones

DJI Matrice 4 Series

The DJI Matrice 4 Series is DJI’s next-generation flagship for complex industrial inspections. It supports advanced payloads, long flight times, and robust redundancy, making it a strong choice for refineries, terminals, ports, and power plants that need reliable, repeatable inspection workflows.

The DJI Matrice 4 Series is DJI’s next-generation flagship for complex industrial inspections. It supports advanced payloads, long flight times, and robust redundancy, making it a strong choice for refineries, terminals, ports, and power plants that need reliable, repeatable inspection workflows.

- High-end flight performance and long endurance for extended missions.

- Support for multi-sensor payloads to capture visual, thermal, and other data in a single flight.

- Ruggedized design for harsh industrial environments.

- Tightly integrated with DJI’s enterprise software ecosystem for planning and data management.

DJI Matrice 30 Series

The DJI Matrice 30 Series provides a compact, weather-resistant platform that still carries a powerful integrated camera payload. It’s well-suited for teams that need a workhorse inspection drone that can deploy quickly from a vehicle or vessel and handle changing weather.

The DJI Matrice 30 Series provides a compact, weather-resistant platform that still carries a powerful integrated camera payload. It’s well-suited for teams that need a workhorse inspection drone that can deploy quickly from a vehicle or vessel and handle changing weather.

- Integrated zoom, wide, and (on some models) thermal sensors in a single payload.

- IP-rated airframe for operation in rain and challenging conditions.

- Designed for rapid deployment and efficient field operations.

- Common choice for inspections on stacks, flare tips, tank farms, and transmission corridors.

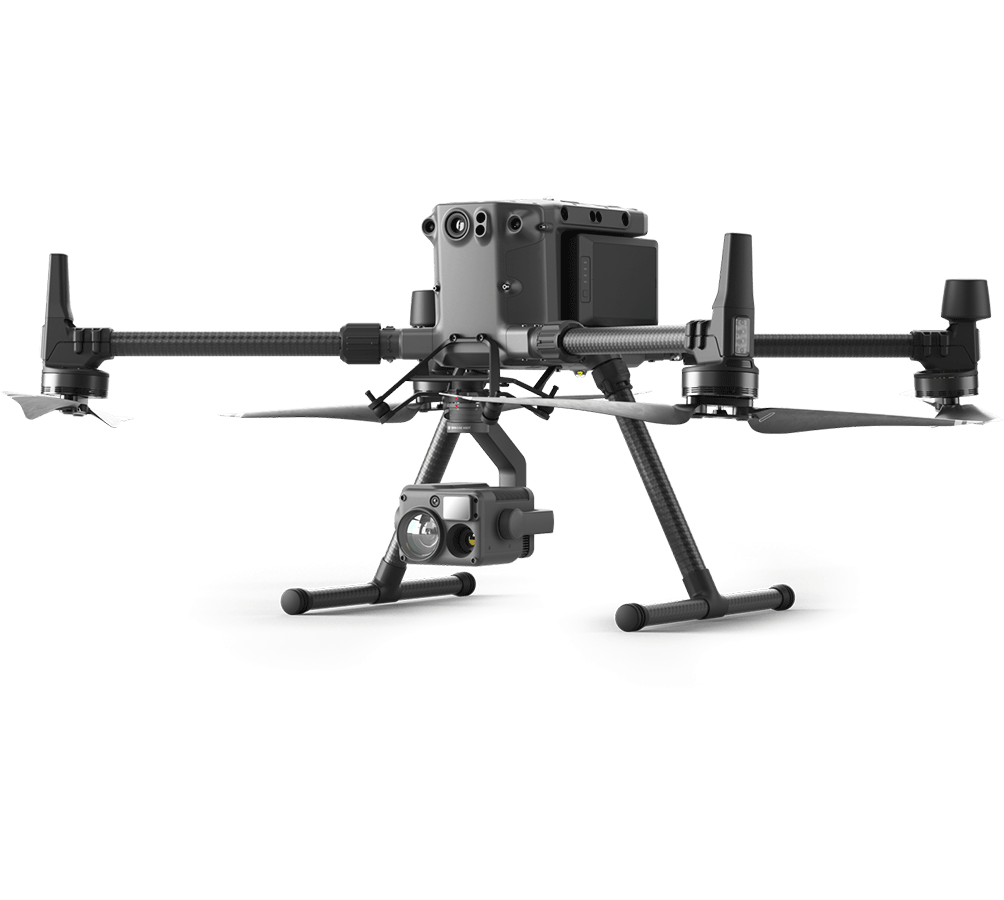

DJI Matrice 300 RTK

The DJI Matrice 300 RTK is a proven workhorse for industrial and utility inspections. With RTK positioning, long flight times, and support for multiple gimbals, it remains a staple platform for teams that need stable, survey-grade data collection.

The DJI Matrice 300 RTK is a proven workhorse for industrial and utility inspections. With RTK positioning, long flight times, and support for multiple gimbals, it remains a staple platform for teams that need stable, survey-grade data collection.

- RTK-enabled positioning for precise flight paths and repeatable data capture.

- Support for multiple payloads, including zoom and thermal cameras.

- Long endurance for large-area or high-altitude inspections.

- Widely used for power lines, pipelines, and critical-infrastructure surveys.

DJI Matrice 350 RTK

The DJI Matrice 350 RTK builds on the M300 platform with upgraded avionics, improved flight performance, and enhanced safety features. It’s a strong option for operators standardizing on DJI’s current-generation industrial platform.

The DJI Matrice 350 RTK builds on the M300 platform with upgraded avionics, improved flight performance, and enhanced safety features. It’s a strong option for operators standardizing on DJI’s current-generation industrial platform.

- Improved flight performance and battery system over the M300 RTK.

- RTK support for precise path-following and repeat surveys.

- Compatible with a wide range of DJI enterprise payloads.

- Suitable for long-range, high-altitude, and BVLOS-style inspection profiles (where regulations allow).

DJI Matrice 400

The DJI Matrice 400 is designed as a robust, future-facing inspection platform with support for heavier payloads and advanced workflows. It gives asset owners and service providers an upgrade path beyond older Matrice models while maintaining compatibility with existing DJI tooling.

The DJI Matrice 400 is designed as a robust, future-facing inspection platform with support for heavier payloads and advanced workflows. It gives asset owners and service providers an upgrade path beyond older Matrice models while maintaining compatibility with existing DJI tooling.

- Enhanced payload capacity and endurance for demanding inspection missions.

- Supports advanced sensing packages and future payload upgrades.

- Built for 24/7 industrial operations in demanding environments.

- Ideal for organizations standardizing fleets around DJI’s latest inspection platform.

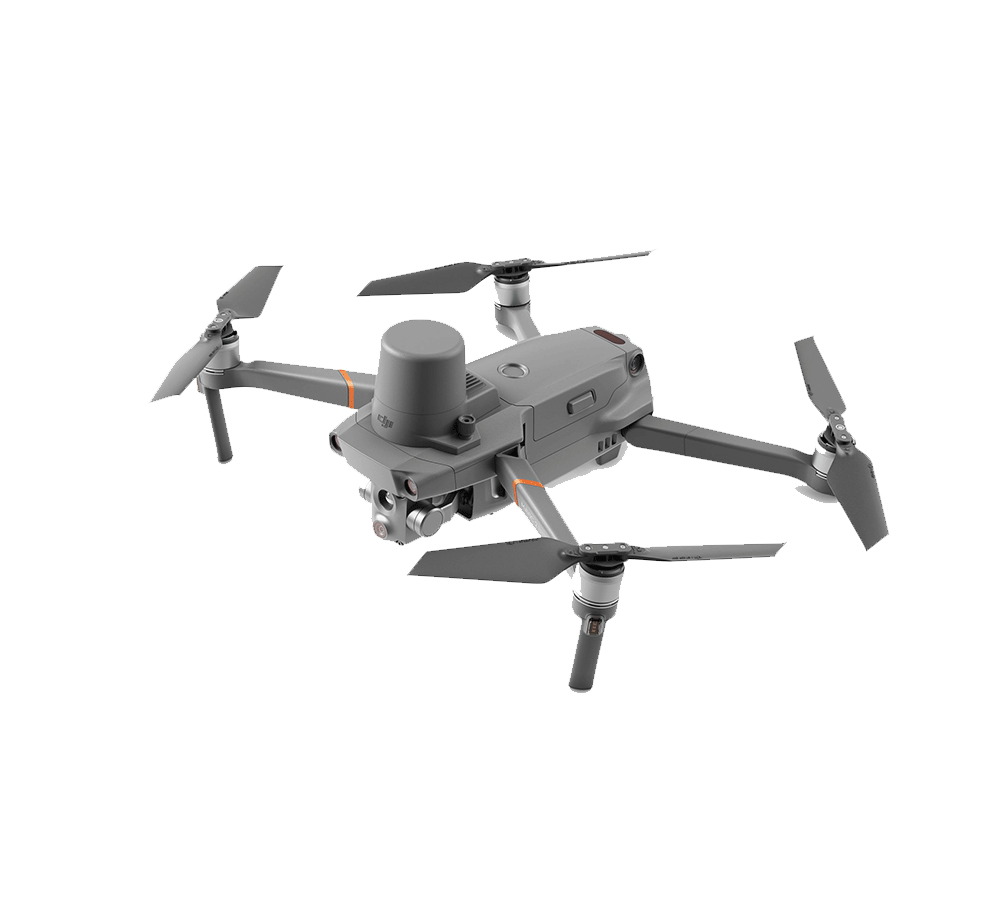

DJI Mavic 2 Enterprise Advanced

The DJI Mavic 2 Enterprise Advanced is a compact, foldable enterprise drone that combines a visual camera with a high-resolution thermal sensor. It remains a practical option for close-range industrial inspections, localized surveys, and rapid-response work.

The DJI Mavic 2 Enterprise Advanced is a compact, foldable enterprise drone that combines a visual camera with a high-resolution thermal sensor. It remains a practical option for close-range industrial inspections, localized surveys, and rapid-response work.

- Portable, easy-to-deploy platform for field teams.

- Integrated thermal and visual cameras for dual-mode inspections.

- Good fit for facility-level checks, leak-detection support, and emergency response.

- Useful as a secondary or backup inspection platform alongside larger Matrice systems.

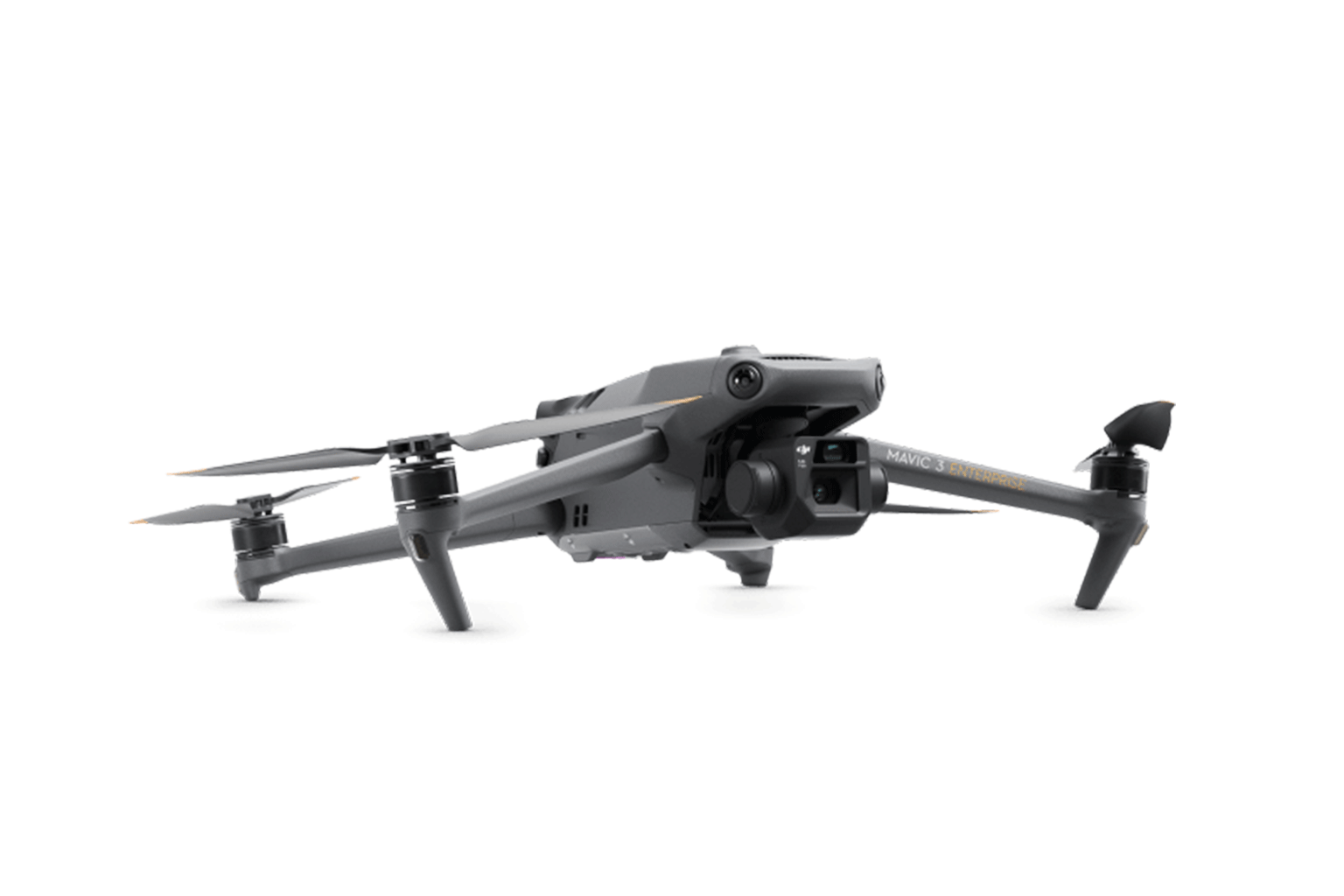

DJI Mavic 3 Enterprise Series

The DJI Mavic 3 Enterprise Series offers a modern, compact inspection platform with improved imaging, flight time, and safety features over older Mavic models. It’s a strong fit for operators who need professional-grade data without a full-size Matrice system.

The DJI Mavic 3 Enterprise Series offers a modern, compact inspection platform with improved imaging, flight time, and safety features over older Mavic models. It’s a strong fit for operators who need professional-grade data without a full-size Matrice system.

- High-resolution camera with powerful zoom capabilities.

- Longer flight times in a compact, foldable airframe.

- Built-in enterprise features like advanced obstacle sensing and RTK options (on some models).

- Suitable for rooftop surveys, structural inspections, and general industrial monitoring.

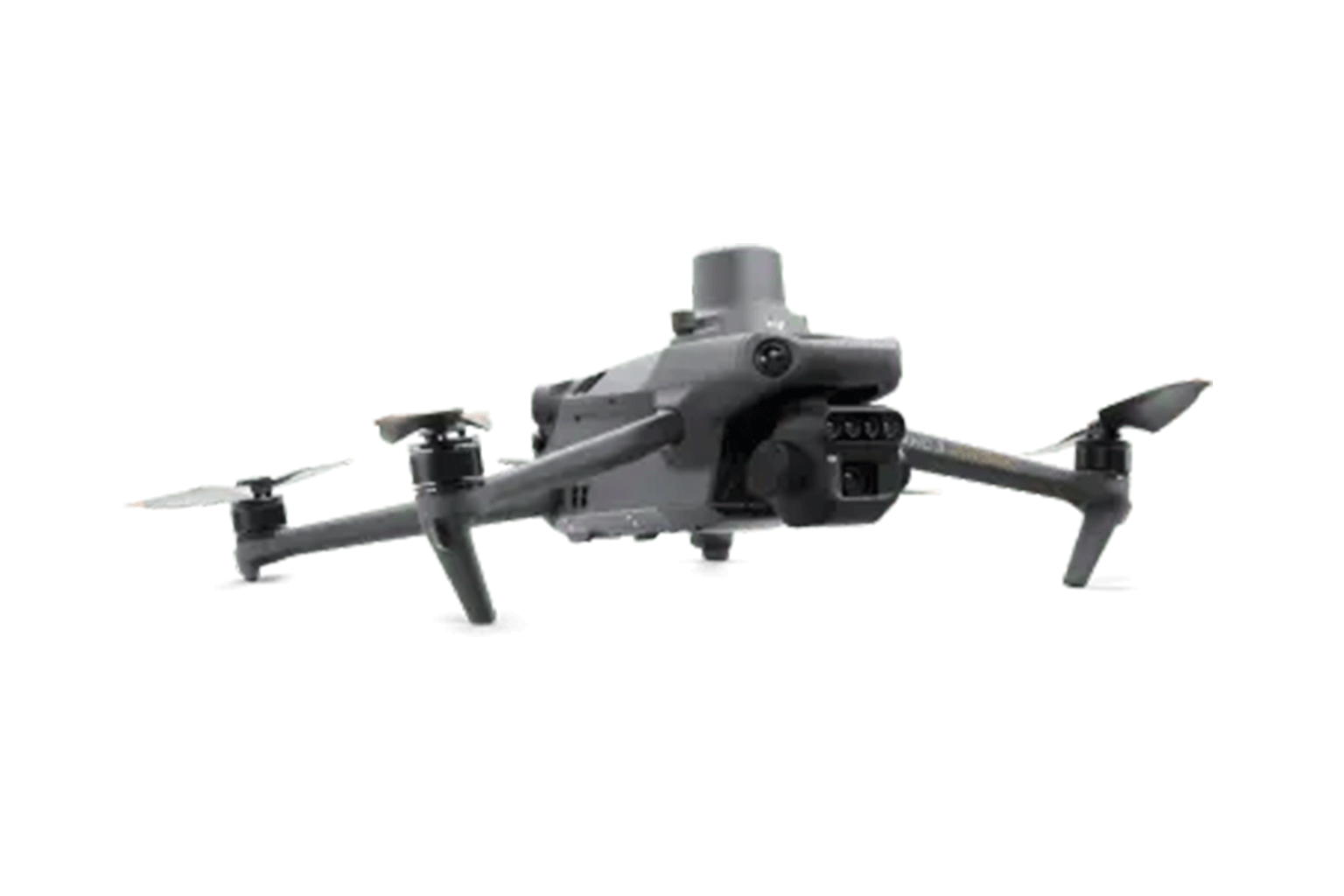

DJI Mavic 3 Multispectral

The DJI Mavic 3 Multispectral pairs a high-quality RGB camera with multispectral sensors, allowing operators to see beyond the visible spectrum. While common in agriculture, it also has niche industrial applications where material changes or surface conditions can be tracked spectrally.

The DJI Mavic 3 Multispectral pairs a high-quality RGB camera with multispectral sensors, allowing operators to see beyond the visible spectrum. While common in agriculture, it also has niche industrial applications where material changes or surface conditions can be tracked spectrally.

- Multispectral and RGB imaging in a single compact platform.

- Useful for right-of-way monitoring, vegetation management, and environmental surveys around industrial assets.

- Integrates with mapping workflows for orthomosaics and NDVI-style analyses.

- Foldable and easily transported between sites.

DJI Mavic 3 Thermal

The DJI Mavic 3 Thermal is a compact thermal-imaging platform built around the Mavic 3 airframe. It’s an efficient choice for teams that need to detect hot spots, insulation failures, or other temperature-driven anomalies around industrial facilities.

The DJI Mavic 3 Thermal is a compact thermal-imaging platform built around the Mavic 3 airframe. It’s an efficient choice for teams that need to detect hot spots, insulation failures, or other temperature-driven anomalies around industrial facilities.

- Integrated thermal and visual cameras for detailed inspection data.

- Excellent for electrical inspections, flare and stack checks, and leak-detection support.

- Large flight-time improvements over older Mavic thermal platforms.

- Portable enough for rapid deployment from trucks, vessels, or small sites.

What Is the DJI Ban?

The 2025 NDAA mandates that a U.S. national-security agency must complete a formal security review of DJI by December 23, 2025.

If that review is not completed, DJI will be automatically added to the FCC Covered List—effectively banning the company from U.S. operations.

Being placed on the Covered List would not disable existing drones, but it would restrict new imports and approvals for DJI products moving forward. This could significantly affect long-term procurement, spare-parts pipelines, and support availability for industrial programs that rely on DJI platforms.

DJI has issued several statements urging the government to initiate the review, emphasizing that it is prepared to participate and has “nothing to hide.” But no audit seems to be scheduled or underway, making it seem likely the ban will go into effect.

For inspection teams planning 2026 projects, this creates a scenario where existing operations remain legal and viable while the future availability of new DJI hardware may become constrained.

What Is the FCC Covered List?

The FCC Covered List identifies companies whose equipment is considered a potential national-security risk under U.S. telecommunications law.

Being added to the list primarily affects:

- New equipment authorizations. DJI could be blocked from receiving FCC approval for new drones, controllers, or wireless components.

- Imports of new DJI products. Without authorization, new DJI hardware cannot be legally imported for sale in the U.S.

- Resale of newly imported units. Retailers and distributors would be unable to restock new DJI drones once existing inventory is depleted.

Importantly, this process does not grant the FCC authority to shut down existing DJI drones or prevent operators from using equipment they already own.

The focus is on controlling future market access, not grounding active fleets.

Why the NDAA Deadline Matters

The NDAA language creates a simple “pass or trigger” scenario:

- If a national-security agency completes a formal audit and clears DJI, the company remains off the Covered List and can continue importing new products.

- If no agency completes the review, DJI is added to the list automatically, regardless of whether any actual security concerns are documented.

For industrial operators, the automatic trigger is what has created the most uncertainty.

A listing would not disrupt current flight operations, but it would tighten the market for new DJI hardware, limit future product launches, and could lead to slower access to firmware updates, repairs, and spare parts as supply chains adjust.

What Happens Immediately If DJI Is Added?

If the deadline passes without a completed audit, the practical impacts would include:

- New DJI imports pause until further notice.

- Existing U.S. inventory can still be sold—but stock would gradually diminish.

- Current DJI drones remain fully flyable under FAA rules.

- Future firmware and support may slow as the company focuses on markets outside the U.S.

Put simply, the NDAA mechanism affects the supply of new DJI equipment far more than the operation of devices already in the field.

Inspection teams that rely on DJI platforms will want to plan around lifecycle management, spare-parts availability, and potential diversification—not immediate loss of access.

DJI Alternatives for Industrial Inspections

Even as DJI remains widely used across heavy industries, many organizations are diversifying their fleets to reduce risk, meet procurement requirements, and expand capabilities.

The platforms below are proven in heavy industries like Oil & Gas, power generation, maritime, mining, and manufacturing environments—and every model listed here is available through MFE.

Important note: These DJI alternatives are not consumer drones. These are purpose-built industrial systems designed for confined-space entry, autonomous mapping, NDT workflows, tactical operations, and high-precision outdoor inspections.

Autonomous Outdoor Drones

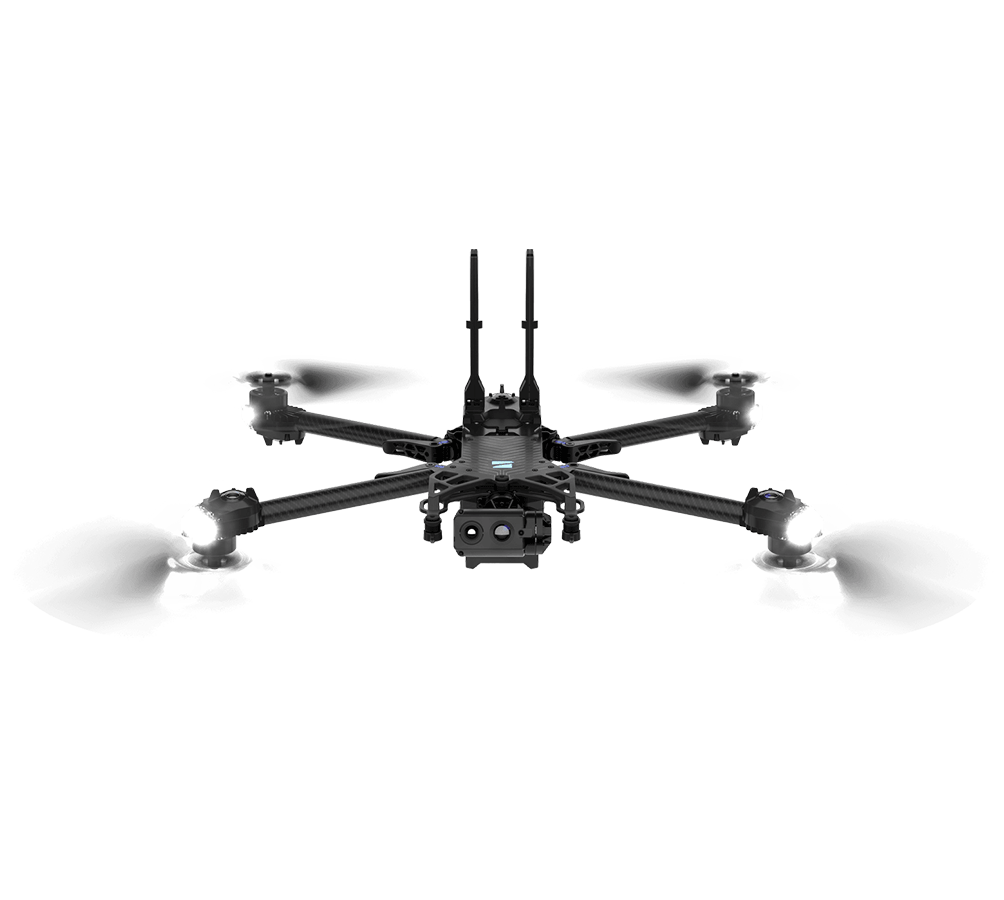

Skydio X2

Skydio X2 is designed for enterprise operations requiring secure data handling, long flight times, and reliable autonomy in complex outdoor structures. It is frequently used for utility, infrastructure, and emergency-response applications.

Skydio X10

The Skydio X10 is Skydio’s newest and most capable autonomous drone, built for high-end industrial inspections. It supports swappable sensors, advanced AI navigation, and resilient flight in cluttered, wind-affected outdoor environments.

Indoor / Confined-Space Inspection Drones

Flyability Elios 2

The Flyability Elios 2 is a collision-tolerant indoor drone engineered for tanks, boilers, pressure vessels, kilns, and other confined spaces. It allows inspectors to collect high-quality visual data without entering hazardous environments.

Buy or rent the Flyability Elios 2.

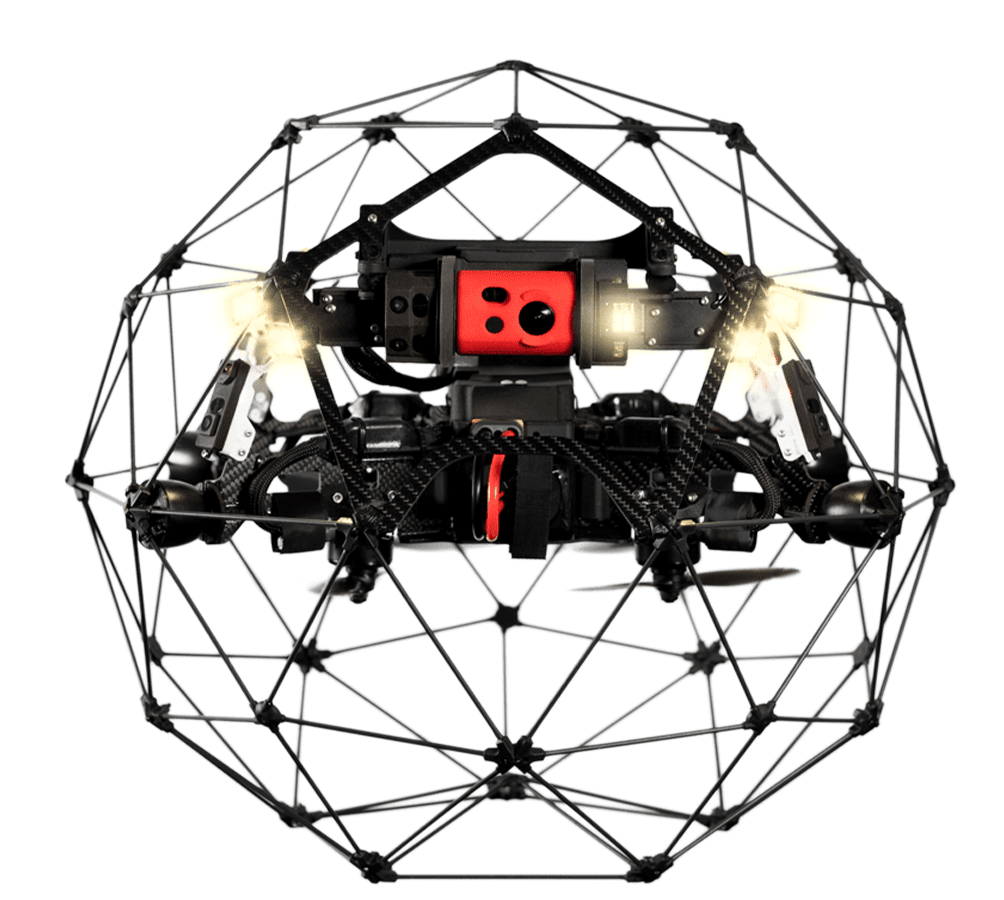

Flyability Elios 3

The Elios 3 introduces LiDAR-based 3D mapping, SLAM navigation, and payload modularity. It is widely used for digital twins, complex internal geometries, and environments where GPS is unavailable and human access is unsafe.

Buy or rent the Flyability Elios 3.

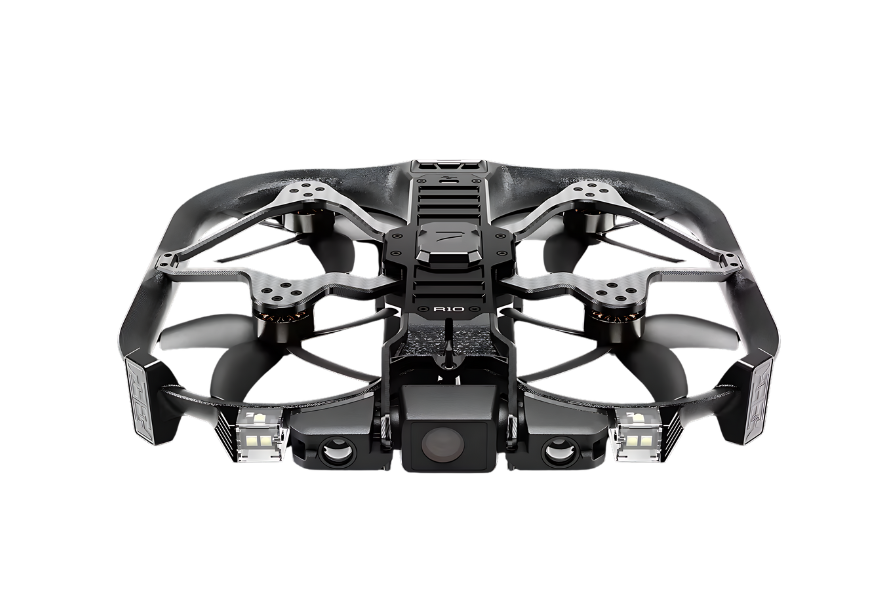

Skydio R10

Skydio R10 is a next-generation indoor inspection platform that uses advanced autonomy to navigate confined and obstacle-dense spaces. It is well suited for power plants, manufacturing facilities, and industrial interiors requiring consistent data collection.

Specialized Outdoor NDT / Vertical Infrastructure

Voliro T

The Voliro T is a unique aerial robotics system designed specifically for contact-based non-destructive testing (NDT). With payloads for UT, EMAT, PEC, DFT, and LPS, it allows technicians to collect data on stacks, columns, tanks, and other vertical structures with unprecedented safety and efficiency.

Industries rely on the Voliro T for inspections that previously required rope access or scaffolding—significantly reducing downtime and improving safety outcomes.

Why DJI Alternatives Matter Right Now

Even if your organization continues to rely on DJI platforms, adding one or more of the above systems builds resilience into your inspection program. These models offer:

- NDAA-compliant operation where required by clients or regulators

- Coverage for specialized missions—indoor, autonomous, or NDT workflows

- Reduced operational risk if DJI imports tighten after December 2025

Each platform is fully supported by MFE, including training, rental options, and fleet-integration guidance to help teams maintain inspection continuity.

How a DJI Ban Could Affect Industrial Inspections

For most industrial operators, the primary concern is not whether DJI drones will suddenly become unusable—they won’t.

The big issue is how a restricted supply of new DJI hardware could influence inspection planning, fleet management, and long-term risk mitigation.

Heavy industries rely on predictable workflows, standardized equipment, and stable maintenance cycles. Any disruption to procurement or support can ripple through an organization’s inspection capabilities.

Inspection Programs Built Around DJI Technology

Over the last decade, DJI platforms have become deeply embedded in industrial inspection programs.

Many teams have standardized on Matrice and Mavic Enterprise systems for:

- Tank, vessel, and flare inspections

- Transmission and distribution line surveys

- Pipeline corridor monitoring

- Rooftop, structural, and right-of-way assessments

- Environmental and thermal anomaly detection

These programs rely on consistent imaging quality, predictable flight performance, and interoperability with established data-management workflows.

If DJI hardware becomes harder to source, teams may face challenges refreshing equipment or scaling up for larger inspection workloads.

Fleet Refresh Cycles May Become Less Predictable

Industrial drone fleets are typically managed like any other critical asset—with lifecycle plans, spare units, and annual refresh budgets.

An automatic FCC listing would not disrupt current operations, but it could make:

- Replacing aging airframes more difficult

- Maintaining consistent sensor packages across sites harder

- Standardizing training on a common platform more challenging

Organizations that operate multiple sites, or rely heavily on consistent data from year to year, may find that continuity is harder to maintain if new units cannot be procured on demand.

Supply Chains for Parts and Repairs Could Tighten

Even if existing DJI drones remain fully functional, the industrial impact becomes more pronounced as spare parts, batteries, and repair pathways begin to constrict.

Over time, operators could encounter:

- Longer lead times for repairs

- Reduced availability of batteries and mission-critical components

- Third-party repair shops facing limited access to OEM parts

For inspection programs with tight schedules—such as turnaround windows or seasonal maintenance cycles—these delays can directly affect project timelines and operational reliability.

Standardized Data Workflows Could Be Disrupted

Many industrial teams have structured their data workflows around DJI’s ecosystem, including:

- Flight planning and mission automation tools

- Payload-specific data formats

- Integration with inspection management platforms

If new DJI products are restricted, future firmware changes or reduced support could introduce complications for organizations with long-term data-archival requirements or strict traceability processes.

The Risk Profile Shifts From “Operational” to “Strategic”

Day-to-day flight operations will largely continue unchanged if DJI is added to the FCC Covered List.

The bigger shift is strategic: industrial operators will need to ensure their drone programs can withstand multi-year procurement restrictions without compromising inspection quality, safety, or regulatory obligations.

Doing this may include diversifying fleets, evaluating non-DJI platforms for specific use cases, and building a more flexible refresh strategy.

What Industrial Operators Should Do Now

A DJI ban does look likely. And that means industrial organizations will benefit from taking a proactive approach.

To be clear, a potential ban would primarily affect new hardware availability—not day-to-day flight operations.

Still, inspection programs depend on predictability, and that’s why we recommend taking these early steps to ensure continuity.

1. Stabilize Your Existing DJI Fleet

If your inspection workflows rely on DJI platforms, now is the time to make sure your current fleet is in its best possible condition.

This includes:

- Updating all firmware while updates remain readily available.

- Documenting flight hours and maintenance history to support lifecycle planning.

- Checking compatibility across batteries, payloads, and controllers to reduce unexpected gaps.

- Standardizing configurations across sites to simplify training and data consistency.

These steps improve operational reliability today and help teams understand which aircraft may need to be replaced or supplemented in 2026 and beyond.

2. Secure Spare Parts, Batteries, and Critical Components

If DJI hardware becomes more difficult to import, certain items will be affected long before entire airframes become scarce—especially consumables and wear-prone parts like batteries, props, and landing gear.

Industrial programs should consider:

- Buying spare batteries for aircraft expected to remain in service for several years.

- Stocking propellers, gimbals, landing gear, and cables in quantities appropriate to mission volume.

- Ensuring redundancy by carrying backup aircraft for critical inspections.

Many large industrial sites already maintain inventory buffers for other tools and sensors. Adopting the same mindset for drone equipment can prevent costly downtime.

3. Evaluate Fleet Vulnerabilities and Dependencies

Every inspection program has a different level of reliance on DJI technology.

Some rely on Matrice aircraft for almost every flight. Others use DJI for rapid response but rely on specialized systems like Flyability’s Elios 3 or Voliro’s Voliro T for complex NDT work.

A quick self-assessment can help your team understand where its risks are concentrated:

- Which missions depend exclusively on DJI hardware?

- Which workflows use DJI-specific formats or cloud tools?

- How long can each airframe remain in service with current parts availability?

This kind of analysis can guide procurement decisions and help prioritize which drones need contingency planning first.

4. Start Evaluating Complementary Non-DJI Platforms

You don’t need to replace your DJI drones. But you may benefit from adding a secondary ecosystem for critical missions or long-term planning.

For example:

- Skydio’s X10 for automated outdoor inspections and obstacle-rich environments

- Flyability’s Elios 2 or 3 for indoor, GPS-denied confined-space inspections

- Voliro T for advanced NDT work (UT, EMAT, PEC, DFT, LPS)

Diversification ensures that if the DJI import pipeline tightens, asset owners and service providers can continue delivering their highest-priority inspections without interruption.

5. Communicate Early With Procurement, Maintenance, and Stakeholders

Inspection teams should coordinate with purchasing departments, reliability engineers, and site leadership to ensure everyone understands the implications of a possible import restriction.

It’s often easier to secure budget for spare units or supplemental platforms before a supply disruption occurs.

6. Document a 12–24 Month Transition Plan

Even if the DJI audit is completed and no ban materializes, having a plan in place strengthens your drone strategy.

A good transition plan includes:

- Expected retirement dates for current DJI airframes

- Spare-parts needs through the next two inspection cycles

- Contingency options for high-priority missions

- Training needs if alternative platforms are introduced

With this level of preparation, industrial programs can continue operating smoothly, regardless of whether DJI faces import restrictions or remains fully available.

Should Industrial Operators Buy DJI Drones Right Now?

For many industrial teams, the most practical question is also the simplest: Is now a good time to buy DJI drones?

The answer depends on your operational needs, but the overall guidance for late 2025 is clear—if DJI platforms are essential to your inspection workflows, and you need predictable capacity for 2026, it may be wise to purchase or stabilize your fleet now while inventory is still available.

Current Availability Is Limited but Still Manageable

DJI stock in the U.S. has been inconsistent throughout 2025.

These fluctuations can be explained by ongoing customs holds, pauses in new FCC equipment authorizations, and general uncertainty surrounding the NDAA deadline.

Some DJI drones have remained available through authorized enterprise distributors like MFE, while others have seen extended delays.

Inventory can shift quickly depending on shipment timing and regulatory updates. Organizations that rely on Matrice- or Mavic-series drones for core inspection work may want to secure needed units sooner rather than later—especially if they anticipate increased inspection volume in 2026 or if older airframes are approaching end-of-life.

If You Need a Fleet Refresh in 2026, Waiting Could Introduce Risk

If DJI is added to the FCC Covered List, new imports would pause immediately.

Existing U.S. stock could still be sold, but supply would tighten significantly once that inventory turns over.

For industrial operators with multi-site inspection programs, this can create several challenges:

- Maintaining consistency across teams that rely on the same model and payloads

- Scaling inspections if additional aircraft are needed for shutdowns or major projects

- Replacing airframes with rising hours or aging batteries

If your team is already planning capital purchases for the next fiscal year, bringing those forward may help reduce future risk.

What About Buying Used DJI Drones?

The used market remains active, but industrial operators should be cautious.

DJI enforces a strict account-binding policy, meaning: You must be able to unbind and rebind the drone to your own DJI account.

If the seller cannot complete the unbinding process, the drone may not activate, update, or operate correctly under your own credentials.

For operators with regulatory obligations, reliability requirements, or internal cybersecurity policies, buying used may also introduce data-handling and maintenance-history uncertainties that are not acceptable for critical inspection programs.

Bottom Line: Buy if It Supports Inspection Continuity

If DJI drones play a central role in your organization’s inspection workflows—and if consistent availability is important to your 2026 plans—purchasing or reinforcing your fleet now is a reasonable strategy.

Existing DJI drones will remain fully flyable under FAA rules, and having the right number of units in service ensures continuity even if new imports become limited.

State and Local Restrictions: What Heavy-Industry Teams Need to Know

While the NDAA audit deadline is driving the national conversation around a potential DJI ban, many industrial operators also work in jurisdictions where state or local restrictions influence procurement and operational choices.

These rules primarily target government agencies—not private-sector companies—but they still matter for industrial teams that collaborate with public partners or operate near critical infrastructure.

State-Level Bans Affect Government Agencies, Not Industrial Operators

Most state-level DJI bans and restrictions passed in recent years apply to police, fire, DOT units, and other public agencies. They do not restrict private-sector industrial use of DJI drones for inspections, surveying, emissions monitoring, or environmental compliance.

However, these laws can indirectly affect industrial teams when:

- Clients or partners are required to use non-DJI equipment

- Joint operations involve state agencies using Blue/Green UAS platforms

- Procurement rules influence site-access requirements or contracted deliverables

Understanding these trends helps operators plan mixed-fleet strategies and ensure alignment with local requirements.

States with Active Restrictions

As of December 2025, several U.S. states have implemented procurement rules or outright bans on Chinese-made drones, including DJI drones, for government agency use.

Here’s a list:

- Florida . One of the earliest statewide bans. All public agencies must replace Chinese-made drones. The transition has created significant cost and capability challenges for local departments.

- Arkansas. Restricts public entities from purchasing drones made in China or containing key Chinese components.

- Texas. Limits state agencies from procuring or deploying certain foreign-manufactured drones, including DJI.

- Mississippi. As of January 2025, state agencies may only purchase drones from U.S.-based manufacturers.

- Nevada. A 2025 law allows the state to specifically approve or ban vendors for agency procurement.

States and Cities Considering Additional Restrictions

Several states have proposed new rules, though none have passed as of December 2025:

- California. Multiple bills introduced to ban or restrict DJI for government use; none have advanced out of committee.

- New York. Procurement-restriction proposals remain in committee with no movement toward passage.

- Georgia, North Carolina, Pennsylvania. Considering similar legislation; no significant progress reported.

- Major cities. Some large metro-area agencies are reviewing procurement standards and could implement local restrictions.

History of the DJI Ban: How We Got Here

To understand why the DJI ban is gaining momentum in late 2025, it helps to look at the broader context.

Concerns about foreign-made drones—especially those manufactured in China—have been circulating among federal agencies for nearly a decade.

Over that period, a patchwork of advisories, grounding orders, procurement rules, and proposed legislation has gradually shaped the policy landscape that now culminates in the NDAA audit requirement.

Here is a timeline of the major developments that led to the impending DJI ban.

2017–2020: The First Wave of Federal Concerns

- 2017. DHS and DoD publicly raise concerns about data security and potential data transfer to foreign servers. The U.S. Army issues a ban on DJI drones for military use.

- 2018. A third-party security review by Kivu Consulting finds no evidence of malicious data exfiltration by DJI drones.

- 2019. DHS issues another advisory warning about risks associated with Chinese-made drones. DJI releases Government Edition drones and offers U.S.-based manufacturing to address concerns.

- 2020. In January, the U.S. Department of the Interior grounds its entire drone fleet—mostly DJI models—citing cybersecurity concerns.

2021–2023: State-Level Bans and Federal Procurement Shifts

- 2021–2023. Multiple states introduce or pass laws restricting DJI and other Chinese-made drones for government use, most notably Florida.

- 2021. A leaked Pentagon report clears Government Edition DJI drones for certain government operations.

- 2023. The American Security Drone Act (ASDA) becomes law, banning federal agencies from operating Chinese-made drones.

2024: Legislative Action Accelerates

- June 2024. DJI disables flight-log syncing for all U.S. users, emphasizing local data control.

- Summer–Fall 2024. The Countering CCP Drones Act gains political traction, ultimately passing the House. Senators introduce additional variations, some including grant programs for public safety agencies.

- December 2024. The final version of the National Defense Authorization Act (NDAA) drops the immediate ban but adds the audit trigger: if no federal agency completes a formal security review of DJI by December 23, 2025, DJI is automatically added to the FCC Covered List.

2025: The Audit Deadline Takes Center Stage

- Early 2025. U.S. Customs begins holding DJI shipments under the Uyghur Forced Labor Prevention Act, tightening supply and causing extended delays for many models.

- Spring 2025. The FCC pauses new equipment authorizations for DJI products pending the NDAA review.

- June 2025. DJI publishes its most extensive Drone Security White Paper to date, outlining encryption, privacy protections, Local Data Mode, and on-premises data options for enterprise teams.

- Summer 2025. DJI drones become increasingly difficult to find in the U.S. due to delayed imports and paused authorizations.

- November 2025. The FCC votes unanimously to expand its authority to ban devices retroactively and include affiliates, subsidiaries, and shell companies tied to entities placed on the Covered List.

- December 2025. DJI publicly states that “as far as we can tell, the audit has not begun.” Industry reporting confirms that no federal agency has initiated the review, and DJI launches a major public campaign urging the government to begin the audit before the deadline.

DJI Ban FAQ for Industrial Operators

Below are the most common questions industrial teams are asking about the DJI ban and what it means for inspections, fleet management, and operational planning going into 2026.

Is DJI banned in the U.S. right now?

No. As of December 2025, there is no active federal ban on DJI drones. However, an automatic ban will take effect on December 23, 2025 if no federal agency completes the required national-security review of DJI before the deadline.

What exactly triggers the DJI ban?

The 2025 National Defense Authorization Act (NDAA) requires a U.S. national security agency to conduct a formal audit of DJI.

If that audit is not completed by December 23, 2025, DJI will be automatically added to the FCC Covered List—a designation that would halt new imports and FCC equipment authorizations for DJI products.

Will my current DJI drones stop working?

No. Existing DJI drones will continue to operate normally. FAA rules for recreational and Part 107 operations do not change.

The ban affects future imports and equipment authorizations, not the functionality of drones you already own.

What happens to support, parts, and firmware?

DJI has stated that it intends to continue supporting existing customers, but if the ban is triggered, there may be:

- Delays or limitations in firmware updates

- Longer repair timelines

- Reduced availability of batteries, gimbals, and other components

Industrial operators should proactively update firmware, secure spare parts, and document fleet status before the deadline.

Can I still buy DJI drones right now?

Yes—if inventory is available. See MFE’s selection of DJI drones here.

DJI stock has been inconsistent in 2025 due to customs holds and paused FCC authorizations, but many enterprise models remain available through authorized distributors like MFE. Availability may tighten sharply if the audit deadline passes without action.

Will used DJI drones still be safe to purchase?

Used drones remain an option, but industrial teams must ensure the seller can unbind the drone from their DJI account. DJI’s strict binding policy means some used drones cannot be reactivated by a new owner unless the prior account holder participates in the transfer.

Does the ban affect batteries and accessories?

Yes. Once DJI is added to the Covered List, imports of batteries and accessories would also be restricted, potentially leading to shortages. Existing U.S. inventory can still be sold until depleted.

Does this ban apply to private industrial operators?

Yes and no.

Private industrial teams can continue using their current DJI drones without restriction.

But if DJI is added to the Covered List, private companies would face the same import limitations as everyone else, resulting in:

- No new DJI drones coming into the U.S.

- No new FCC device authorizations

- Reduced availability of mission-critical parts

How do state bans factor into this?

Most state-level bans impact public agencies—not private industrial operators.

However, industrial teams working with state partners (DOTs, utilities, emergency response agencies) may need NDAA-compliant drones for joint operations.

What if my clients require NDAA-compliant drones?

Many industrial clients are already requesting or mandating NDAA-compliant platforms for certain inspections, especially in oil & gas, utilities, and critical infrastructure.

Systems like the Skydio X10, Flyability Elios 3, and Voliro T are strong alternatives and also available through MFE.

Could the ban be prevented?

Yes, but only if a U.S. national security agency initiates and completes the mandated review before the December 23 deadline. DJI has publicly urged the government to begin the audit, but as of early December 2025, no agency has stepped forward.